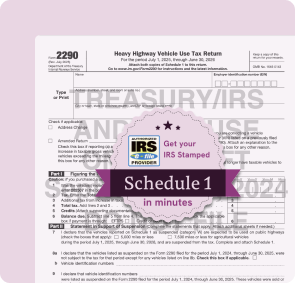

E-File Form 2290 Online IRS Authorized 2290 E-File Provider

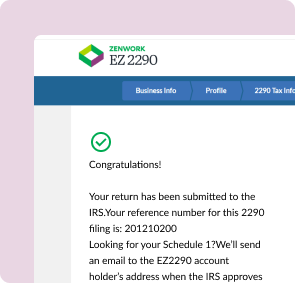

Need to submit IRS Form 2290 for 2025? EZ2290 helps you handle it. We have over a decade of experience in filing Form 2290 electronically as an IRS-approved 2290 e-File provider.

E-File 2290 Now