Form 2290

Weight Correction: How To Report Corrected Weight On Form 2290?

Here’s how you can report the corrected weight of a

IRS Form 2290 for the 2025-26 tax season is now open. Start eFile 2290

Here’s how you can report the corrected weight of a

Here’s a comprehensive guide to help you learn everything about

What to do when your vehicle has less than the

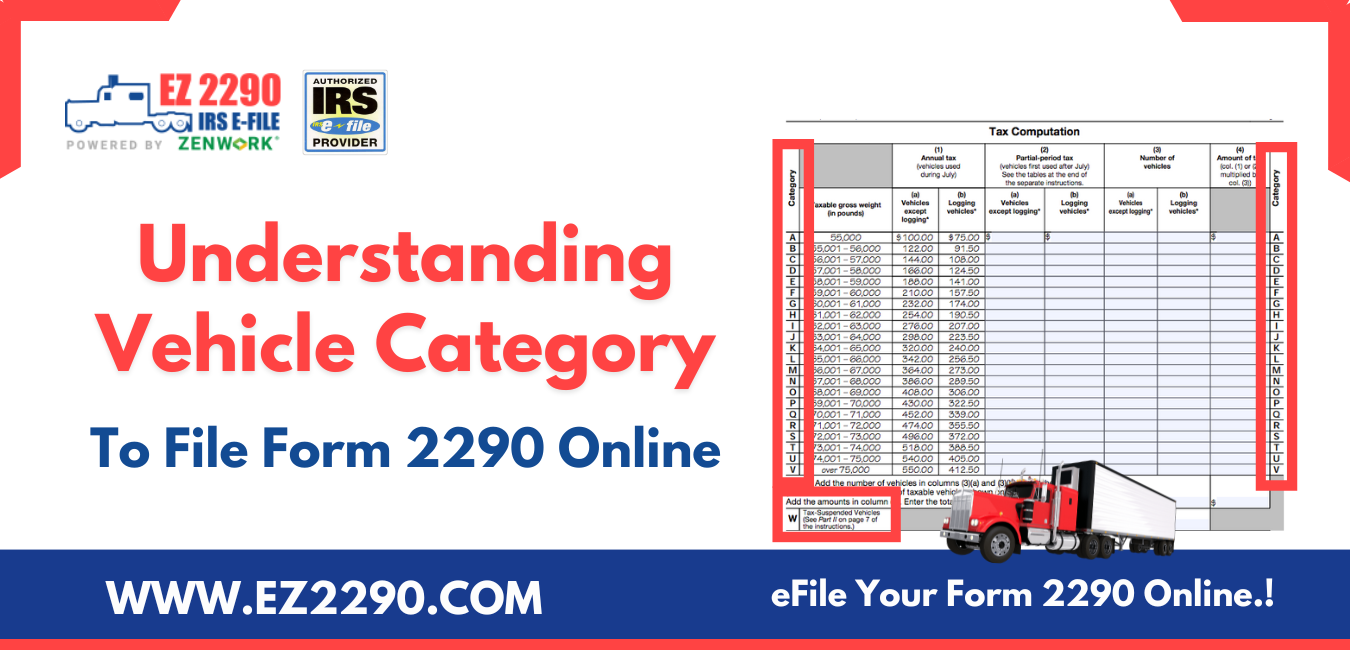

Defining and understanding the taxable vehicles and taxable gross weight

Understanding the role of EIN in 2290 truck tax reporting.

Learn all about HVUT vehicle categories in this simple guide.

IRS HVUT 2290 form is due by August 31, 2022.

IRS rejecting your 2290 returns? Check out the top 10

Here are all the online payment methods as approved by

Reported incorrect business/legal name on HVUT Form 2290? Correct it