HVUT Compliance: How To Re-File Rejected Returns?

Learn how to re-file your rejected Form 2290 returns + tips to establish HVUT compliance. Imagine this; after spending hours

IRS Form 2290 for the 2025-26 tax season is now open. Start eFile 2290

Learn how to re-file your rejected Form 2290 returns + tips to establish HVUT compliance. Imagine this; after spending hours

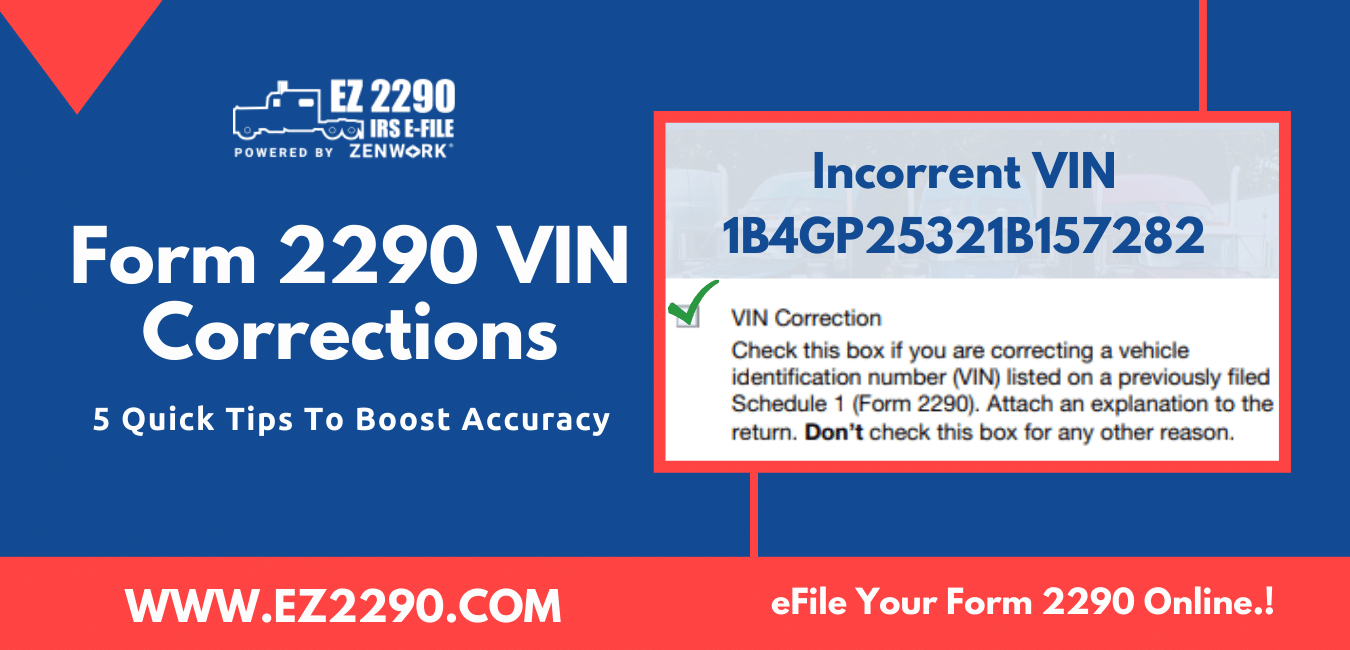

Here are the 3 most important tips you will need to accurately report your vehicle identification numbers (VINs) on HVUT

Here’s how a vehicle identification number plays a huge role in ensuring HVUT compliance for your trucking business. As businesses

Learn how the HVUT compliance enabler, EZ2290 helps trucking businesses like you and how to get the HVUT to support

EZ2290 is an authorized HVUT compliance enabler, helping 10,000+ trucking businesses in the U.S. Maintaining tax compliance for your trucking

Learn the significance 2290 Schedule-1 holds in HVUT compliance + 5 easy tips to receive IRS Stamped Schedule-1 instantly. When

Use Form 8849 to claim a full HVUT refund of the overpaid excise taxes from the IRS with these simple-to-follow

Understand the significance of a vehicle identification number in HVUT e-Files and learn how to eFile Form 2290 VIN Correction

A simple guide to help you understand, prepare, and e-File Form 2290 for the tax year 2020-2021. Businesses within the

Learn the best way to ensure HVUT compliance for your business with the IRS-authorized HVUT Form 2290 compliance tool –

Learn how the 2290 Amendment plays a huge role in ensuring HVUT compliance and “correcting” previously misreported information for trucking

Trucking businesses are preparing to file the HVUT form 2290 for the tax year 2021-2022. So, here’s your complete guide