Are you a truck driver or fleet owner? If so, you must file Form 2290 and obtain a Schedule 1 to prove you’ve paid your Heavy Vehicle Use Tax. Learn more about this crucial document, and don’t risk costly fines and penalties.

You’re no stranger to taxes and regulations if you own or operate a heavy vehicle. One of the most important taxes you’ll need to pay is the Heavy Vehicle Use Tax (HVUT).

But how do you prove that you’ve paid this tax? The answer is Form 2290 Schedule 1, a document that serves as proof of payment for the HVUT.

In this blog, we’ll explore everything you need to know about Form 2290 Schedule 1, including why it’s important, how to obtain it, and what to do if you lose it.

So, let’s dive in and ensure you’re on the right track with your heavy vehicle taxes.

What Is Form 2290 Schedule 1?

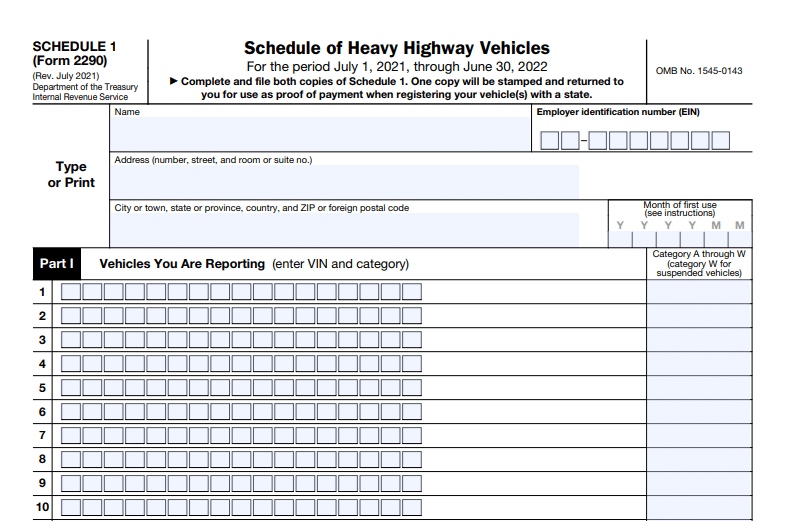

Form 2290 Schedule 1 is a document issued by the Internal Revenue Service (IRS) that serves as proof of payment for the Heavy Vehicle Use Tax (HVUT). HVUT is a federal tax imposed on heavy vehicles operating on public highways with a gross weight of 55,000 pounds or more.

Form 2290 Schedule 1 is a crucial document that shows that you’ve paid this tax for the current tax year. It contains important information, such as the vehicle identification number (VIN), the taxable gross weight, and the date the HVUT was paid.

Without this document, you won’t be able to register your heavy vehicle with the Department of Motor Vehicles (DMV) or renew your vehicle’s registration.

eFile 2023-24 Form 2290 & Get Schedule 1

Who Must File Form 2290 And Schedule 1?

If you own a heavy vehicle with a gross weight of 55,000 pounds or more and operate it on public highways, you must file Form 2290 and obtain a Schedule 1.

This applies to both individual truck drivers and fleet owners. The HVUT is due annually and must be paid by the last day of the month following your vehicle use.

For example, if you start using your heavy vehicle in July, the HVUT is due by August 31st. Failure to file Form 2290 and obtain a Schedule 1 can result in penalties and interest charges, so staying on top of your taxes and deadlines is important.

Remember that leased vehicles also require Form 2290 and Schedule 1, but paying the HVUT may fall on the lessee rather than the lessor.

Form 2290 Schedule 1 Instructions

Form 2290 Schedule 1 Instructions are designed to guide truck drivers and fleet owners who must complete and file Form 2290 and obtain a Schedule 1 for HVUT payment.

These instructions cover various aspects of the process, such as providing accurate personal and vehicle information, determining the vehicle’s taxable gross weight, specifying the month of first use, and providing consent to the disclosure of tax information.

Name & Address

The first step in completing Form 2290 Schedule 1 is to provide accurate personal and business information under the Name & Address section. This includes your name, employer identification number (EIN), and address.

You can use your social security number instead of an EIN if you’re a sole proprietor. It’s important to ensure this information is accurate, as it will be used to verify your identity and contact you if needed.

Additionally, if you’ve changed your name or address since you last filed Form 2290, you must update this information with the IRS before submitting the form.

eFile HVUT Form 2290 For 2023-24 Tax Year

Vehicle Detail

The Vehicle Details section of Form 2290 Schedule 1 requires you to provide specific information about your heavy vehicle, including the vehicle identification number (VIN), taxable gross weight, and whether the vehicle is used for logging.

The VIN is a unique 17-digit number that identifies your vehicle and can be found on your vehicle registration or insurance documents. The taxable gross weight is the combined weight of the vehicle, any trailers, and the maximum load capacity in pounds.

If your vehicle is used for logging, you may be eligible for a lower tax rate.

Schedule 1 (Form 2290) – Month of First Use

The Schedule 1 (Form 2290) – Month of First Use section requires you to specify the month you first used your heavy vehicle during the current tax period. This is important, as the HVUT is due by the last day of the month following the month you first used the vehicle.

For example, if you first used your vehicle in July, the HVUT is due by August 31st. If you’re unsure about the month of first use, you can estimate it based on when you purchased the vehicle or when it was first registered.

Schedule 1 (Form 2290), Consent to Disclosure of Tax Information

The Schedule 1 (Form 2290), Consent to Disclosure of Tax Information section, requires you to consent to disclose your tax information to third parties.

This includes tax return preparers, electronic return originators, and other intermediaries who assist with preparing or filing your tax return. This section is important as it allows the IRS to share your tax information with authorized parties who can help you with your taxes.

It’s important to note that providing consent is optional, and you can choose to withhold consent if you prefer. However, choosing not to consent may limit your ability to obtain assistance with your taxes.

How Can I File Schedule 1 (Form 2290) Online With Ez2290?

If you’re looking for a fast and convenient way to file Schedule 1 (Form 2290) online, EZ2290 is the perfect solution. With EZ2290, you can quickly and easily file your HVUT and receive your Schedule 1 within minutes.

The process is simple and straightforward: create an account, enter your vehicle and payment information, and submit your form to the IRS. Ez2290 offers a user-friendly platform that guides you through the filing process step-by-step and provides instant access to your Schedule 1 once the IRS accepts your form.

By filing online with Ez2290, you can save time, reduce errors, and ensure that your form is filed accurately and on time.

File HVUT Form 2290 Online For 2023-24

Stamped Copy of Schedule 1 As Proof of Payment

When you file Form 2290 Schedule 1 and make your HVUT payment, you’ll receive a stamped copy of your Schedule 1 as proof of payment.

This document is an official receipt and must be kept for your records. You’ll need to provide a copy of your stamped Schedule 1 to register your vehicle with the Department of Motor Vehicles (DMV), renew your registration, and provide proof of payment to authorities during roadside inspections.

It’s important to ensure you have a valid, stamped copy of your Schedule 1 while operating your heavy vehicle, as failure to provide proof of payment can result in penalties and fines.

What To Look For In Form 2290 Schedule 1 Stamped Copy?

When you receive your stamped copy of Form 2290 Schedule 1, you should verify a few key details to ensure that it is accurate and valid.

First, check that the IRS has properly stamped the form with the payment date. Next, confirm that the Vehicle Identification Number (VIN) and other vehicle details match those on your registration documents. Finally, double-check that your name and address are correct and that the form reflects the correct tax period.

By reviewing these details carefully, you can ensure that your stamped copy of Form 2290 Schedule 1 is accurate and valid and that you have the necessary proof of payment to operate your heavy vehicle legally.

eFile Form 2290 Online For 2023-24 & Get Schedule 1

Conclusion

In conclusion, Form 2290 Schedule 1 is critical for heavy vehicle owners and operators. It is proof of payment for the Heavy Vehicle Use Tax (HVUT) and must be kept on hand while operating your vehicle.

By understanding the importance of this form and following the steps to file and obtain a stamped copy, you can ensure that you comply with the IRS and other authorities and avoid costly penalties and fines.

Remember, with the convenience of online filing options such as Ez2290; it has never been easier to obtain the necessary proof of payment for your heavy vehicle.

1-877-811-ETAX

1-877-811-ETAX