Easily eFile Form 2290 Online With EZ2290

If you’re looking for a quick and easy way to File 2290 online, look no further than EZ2290. As an IRS-authorized eFiling service provider, EZ2290 offers a streamlined process for submitting your heavy highway vehicle use tax return.

Here are some prominent features of EZ2290 that make it a perfect fit for your eFiling needs:

- Automatic tax calculations: EZ2290 offers automatic tax calculations, which means the system will calculate the tax owed based on your vehicle’s weight and other factors, making it easy to file your taxes correctly.

- Bulk Upload: With EZ2290, you can upload multiple vehicles simultaneously, saving time and effort. You can also save vehicle information for future use, making it easier to file taxes in subsequent years.

- Paperless storage: EZ2290 offers paperless storage, meaning you can access all your tax documents online, anytime, anywhere. This is a great way to keep track of your tax filings and ensure that you never lose important documents.

- Free VIN corrections: If you make a mistake in your VIN number, EZ2290 offers free VIN corrections, ensuring you can file your taxes correctly and avoid penalties.

- Penalty prevention: EZ2290 offers a penalty prevention program, ensuring you never miss a deadline or file your taxes incorrectly, helping you avoid costly penalties.

- Bank-grade security: EZ2290 uses bank-grade security to protect your personal and financial information, ensuring your data is safe and secure.

- Mobile-friendly website: The EZ2290 website is mobile-friendly, meaning you can file taxes from anywhere, using any device.

These features make EZ2290 an excellent choice for anyone who needs to file Form 2290. The platform is easy to use, secure, and reliable, ensuring you can file your taxes quickly and accurately without hassle or stress.

Due Dates For Filing Form 2290

Form 2290 is an annual tax form used to report and pay Heavy Vehicle Use Tax (HVUT) to the IRS. The Form 2290 due date depends on the vehicle’s first use month. Here are the key due dates to keep in mind:

- For vehicles first used in July: August 31st of the same year

- For vehicles first used in August: September 30th of the same year

- For vehicles first used in September: October 31st of the same year

- For all other vehicles, the due date is August 31st of the following year

Understanding IRS Form 2290 Schedule 1

IRS Form 2290 Schedule 1 is proof of payment for the Heavy Vehicle Use Tax (HVUT) required for any vehicle with a gross weight of 55,000 pounds or more. The Schedule 1 form is issued by the IRS after the HVUT payment is made, either by paper filing or e-filing.

It shows the date of payment, the amount of tax paid, and the vehicle identification number (VIN) of the taxed vehicle. This form is required for many activities related to owning and operating a heavy vehicle, including registration, renewals, and other federal filings.

What Is the Form 2290 Amendment?

Form 2290 Amendment is a process to make changes or corrections to the information provided on the original Form 2290 filed for Heavy Vehicle Use Tax (HVUT). Amendments may be required for several reasons, such as VIN corrections, taxable gross weight increases, and adding or removing vehicles from the original filing.

It is essential to file an amendment to avoid any potential penalties or issues with the IRS. Filing a Form 2290 Amendment is similar to filing the original form and can be done electronically using an authorized e-file provider or through the mail by sending a paper form.

What Are The Penalties For Not Filing Form 2290

You’ll face penalties and interest charges if you don’t file Form 2290 or pay your HVUT by the deadline. The penalty for late filing is 4.5% of the total tax due, assessed monthly for up to five months. The penalty for failure to pay the tax due on time is 0.5% of the unpaid tax amount, assessed every month for up to five months.

Conclusion

In conclusion, Form 2290 is a crucial document for heavy vehicle owners that serves as proof of payment for the Heavy Vehicle Use Tax (HVUT). The HVUT is a federal tax that helps fund road and highway maintenance across the United States.

It is important to understand the purpose of Form 2290, its due dates, and how to properly file it to avoid any penalties or issues with the IRS. Using an authorized eFiling service provider such as EZ2290 can simplify the process and ensure that your tax filings are accurate and timely.

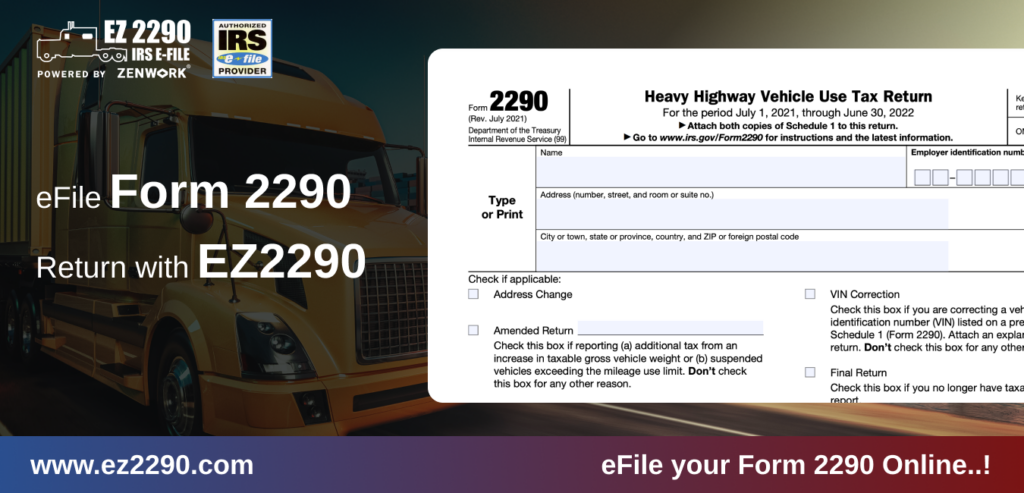

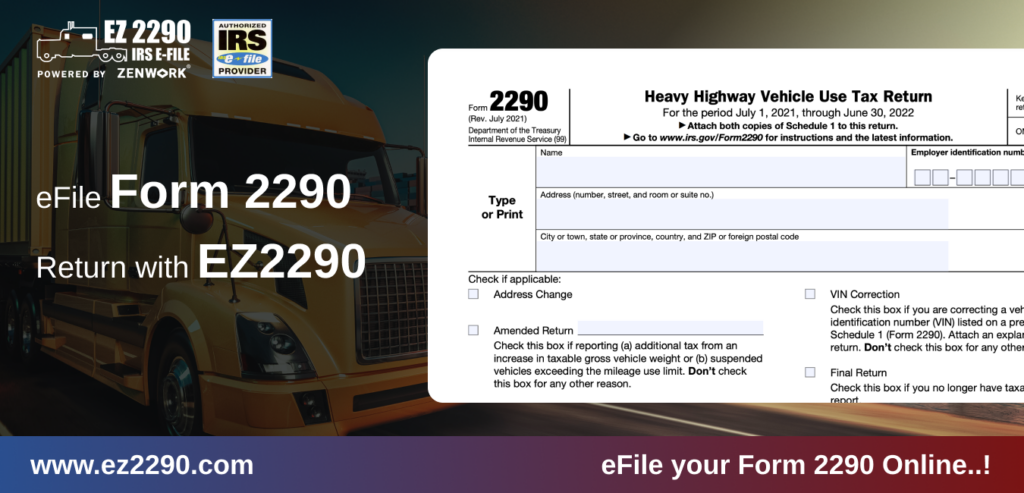

Form 2290 Boxes Explained

Form 2290 is a crucial tax form for truck owners and operators. To accurately report and pay the federal excise tax on heavy highway vehicles, it’s important to understand the various boxes on the form. Here’s a guide to help you understand what each box on Form 2290 means:

Box 1: Enter the taxable gross weight of the vehicle and any trailers for the period from July 1 to June 30.

Box 2: Check whether you report the current tax period or an amended return.

Box 3: Enter the vehicle’s vehicle identification number (VIN). This should be a 17-character alphanumeric code that’s unique to each vehicle.

Box 4: Enter the name and address of the person or business that owns the vehicle.

Box 5: Check whether the vehicle is used for agricultural purposes.

Box 6: Check whether the vehicle is a logging vehicle.

Box 7: Enter the miles the vehicle is expected to travel during the tax period if it’s a suspended vehicle.

Box 8: Check whether you’re filing as an individual or a business.

Box 9: Enter the name and address of the person to contact if the IRS has questions about the return.

Box 10: Enter the Electronic Filing Identification Number (EFIN) if you’re a tax professional e-filing the return.

Box 11: Enter the federal excise tax due for the vehicle.

Box 12: Enter the date the vehicle was first used on public highways during the tax period.

By understanding what each box on Form 2290 means, you can ensure that you accurately report the necessary information and pay the correct amount of federal excise tax.

How Do I Fill Out Form 2290?

- Gather all necessary information: Before starting to fill out Form 2290, make sure you have all the necessary information, including your Employer Identification Number (EIN), Vehicle Identification Numbers (VINs) for each vehicle, and taxable gross weight for each vehicle.

- Choose your filing method: Decide whether to file Form 2290 electronically or by paper. Filing form 2290 electronically is quicker and easier, but if you file by paper, send it to the correct IRS address.

- Fill out the basic information: In Part, I, enter your business name, address, and EIN.

- Fill out the vehicle information: In Part II, enter each vehicle’s VIN and taxable gross weight.

- Indicate any special circumstances: Check the appropriate boxes in Part III if your vehicle is used exclusively for agriculture, if you are suspending tax for a vehicle that travels less than 5,000 miles, or if the vehicle was sold or destroyed during the tax period.

- Calculate the tax: In Part IV, calculate the tax due based on the taxable gross weight of each vehicle.

- Sign and date the form: In Part V, sign and date the form to certify the correct information.

By following these steps and filling out the form accurately, you can ensure that your Form 2290 is filed correctly and avoid any potential penalties or delays.

How Do I eFile Form 2290?

Here’s a step-by-step guide on how to eFile Form 2290:

- Choose an IRS-authorized e-file provider: You can find a list of approved e-file providers on the IRS website. Make sure you choose a reputable provider that meets your needs.

- Gather your information: You will need your EIN, VINs for each vehicle, and the taxable gross weight for each vehicle.

- Create an account with your chosen eFile provider: Follow the instructions to create an account with your chosen IRS approved 2290 e-file provider. EZ2290 is an IRS-authorized eFile service provider for Form 2290, create an account now and file HVUT 2290 Forms in three simple steps.

- Enter your business information: Your business name, address, and other relevant information must be entered.

- Enter your vehicle information: You must enter each vehicle’s VIN and taxable gross weight.

- Calculate your tax: The e-file provider will automatically calculate the tax due based on your provided information.

- Submit your form: Review it to ensure all the information is accurate, and then submit it to the IRS through your e-file provider.

- Pay your tax: You can pay your tax electronically using various payment methods, including electronic funds withdrawal (EFW), credit card, or electronic federal tax payment system (EFTPS).

- Receive your stamped Schedule 1: Once the IRS accepts your form and payment, you will receive a stamped Schedule 1 as proof of payment. You can download a copy of this document from your eFile provider’s website.

Easily eFile Form 2290 Online With EZ2290

If you’re looking for a quick and easy way to File 2290 online, look no further than EZ2290. As an IRS-authorized eFiling service provider, EZ2290 offers a streamlined process for submitting your heavy highway vehicle use tax return.

Here are some prominent features of EZ2290 that make it a perfect fit for your eFiling needs:

- Automatic tax calculations: EZ2290 offers automatic tax calculations, which means the system will calculate the tax owed based on your vehicle’s weight and other factors, making it easy to file your taxes correctly.

- Bulk Upload: With EZ2290, you can upload multiple vehicles simultaneously, saving time and effort. You can also save vehicle information for future use, making it easier to file taxes in subsequent years.

- Paperless storage: EZ2290 offers paperless storage, meaning you can access all your tax documents online, anytime, anywhere. This is a great way to keep track of your tax filings and ensure that you never lose important documents.

- Free VIN corrections: If you make a mistake in your VIN number, EZ2290 offers free VIN corrections, ensuring you can file your taxes correctly and avoid penalties.

- Penalty prevention: EZ2290 offers a penalty prevention program, ensuring you never miss a deadline or file your taxes incorrectly, helping you avoid costly penalties.

- Bank-grade security: EZ2290 uses bank-grade security to protect your personal and financial information, ensuring your data is safe and secure.

- Mobile-friendly website: The EZ2290 website is mobile-friendly, meaning you can file taxes from anywhere, using any device.

These features make EZ2290 an excellent choice for anyone who needs to file Form 2290. The platform is easy to use, secure, and reliable, ensuring you can file your taxes quickly and accurately without hassle or stress.

Due Dates For Filing Form 2290

Form 2290 is an annual tax form used to report and pay Heavy Vehicle Use Tax (HVUT) to the IRS. The Form 2290 due date depends on the vehicle’s first use month. Here are the key due dates to keep in mind:

- For vehicles first used in July: August 31st of the same year

- For vehicles first used in August: September 30th of the same year

- For vehicles first used in September: October 31st of the same year

- For all other vehicles, the due date is August 31st of the following year

Understanding IRS Form 2290 Schedule 1

IRS Form 2290 Schedule 1 is proof of payment for the Heavy Vehicle Use Tax (HVUT) required for any vehicle with a gross weight of 55,000 pounds or more. The Schedule 1 form is issued by the IRS after the HVUT payment is made, either by paper filing or e-filing.

It shows the date of payment, the amount of tax paid, and the vehicle identification number (VIN) of the taxed vehicle. This form is required for many activities related to owning and operating a heavy vehicle, including registration, renewals, and other federal filings.

What Is the Form 2290 Amendment?

Form 2290 Amendment is a process to make changes or corrections to the information provided on the original Form 2290 filed for Heavy Vehicle Use Tax (HVUT). Amendments may be required for several reasons, such as VIN corrections, taxable gross weight increases, and adding or removing vehicles from the original filing.

It is essential to file an amendment to avoid any potential penalties or issues with the IRS. Filing a Form 2290 Amendment is similar to filing the original form and can be done electronically using an authorized e-file provider or through the mail by sending a paper form.

What Are The Penalties For Not Filing Form 2290

You’ll face penalties and interest charges if you don’t file Form 2290 or pay your HVUT by the deadline. The penalty for late filing is 4.5% of the total tax due, assessed monthly for up to five months. The penalty for failure to pay the tax due on time is 0.5% of the unpaid tax amount, assessed every month for up to five months.

Conclusion

In conclusion, Form 2290 is a crucial document for heavy vehicle owners that serves as proof of payment for the Heavy Vehicle Use Tax (HVUT). The HVUT is a federal tax that helps fund road and highway maintenance across the United States.

It is important to understand the purpose of Form 2290, its due dates, and how to properly file it to avoid any penalties or issues with the IRS. Using an authorized eFiling service provider such as EZ2290 can simplify the process and ensure that your tax filings are accurate and timely.

Form 2290 Taxable Gross Weight: What You Need To Know

Taxable gross weight is the total weight of a vehicle, including any load it carries, excluding any trailers. This weight determines if truck owners and operators must file Form 2290 and pay federal excise tax on vehicles with a taxable gross weight of 55,000 pounds or more. Taxable gross weight is the vehicle’s weight when fully loaded and ready for use on public highways.

Knowing the taxable gross weight of your vehicle is crucial when filing Form 2290. Truck owners and operators must accurately report the taxable gross weight of their vehicles to ensure they pay the correct amount of federal excise tax. In addition, failure to file or pay the tax on time can result in penalties and interest charges.

Exceptions For Form 2290

While most truck owners and operators are required to file Form 2290 and pay the federal excise tax on heavy highway vehicles, there are certain exceptions to this requirement. Here are some of the most common exceptions for Form 2290:

- Low Mileage Vehicles: If a vehicle is expected to travel less than 5,000 miles during the tax period (July 1 to June 30), it is considered a low mileage vehicle and is exempt from the federal excise tax.

- Government Vehicles: Vehicles owned and operated by the federal government, state governments, local governments, and Indian tribal governments are exempt from the federal excise tax.

- Agricultural Vehicles: Vehicles used primarily for farming purposes and with a gross weight of 55,000 pounds or less are exempt from the federal excise tax.

- Qualified Blood Collector Vehicles: Blood collector vehicles operated by qualified blood collector organizations are exempt from the federal excise tax.

- Special Mobile Machinery: Vehicles not designed to carry loads over public highways and used exclusively for certain purposes such as construction, manufacturing, and drilling operations are exempt from the federal excise tax.

It’s important to note that while these vehicles may be exempt from the federal excise tax, they may still be required to file Form 2290 for other reasons, such as registering the vehicle with the state or for certain state-specific taxes.

Additionally, certain requirements must be met to qualify for these exemptions, so consulting with a tax professional or the IRS is important for guidance.

Form 2290 Boxes Explained

Form 2290 is a crucial tax form for truck owners and operators. To accurately report and pay the federal excise tax on heavy highway vehicles, it’s important to understand the various boxes on the form. Here’s a guide to help you understand what each box on Form 2290 means:

Box 1: Enter the taxable gross weight of the vehicle and any trailers for the period from July 1 to June 30.

Box 2: Check whether you report the current tax period or an amended return.

Box 3: Enter the vehicle’s vehicle identification number (VIN). This should be a 17-character alphanumeric code that’s unique to each vehicle.

Box 4: Enter the name and address of the person or business that owns the vehicle.

Box 5: Check whether the vehicle is used for agricultural purposes.

Box 6: Check whether the vehicle is a logging vehicle.

Box 7: Enter the miles the vehicle is expected to travel during the tax period if it’s a suspended vehicle.

Box 8: Check whether you’re filing as an individual or a business.

Box 9: Enter the name and address of the person to contact if the IRS has questions about the return.

Box 10: Enter the Electronic Filing Identification Number (EFIN) if you’re a tax professional e-filing the return.

Box 11: Enter the federal excise tax due for the vehicle.

Box 12: Enter the date the vehicle was first used on public highways during the tax period.

By understanding what each box on Form 2290 means, you can ensure that you accurately report the necessary information and pay the correct amount of federal excise tax.

How Do I Fill Out Form 2290?

- Gather all necessary information: Before starting to fill out Form 2290, make sure you have all the necessary information, including your Employer Identification Number (EIN), Vehicle Identification Numbers (VINs) for each vehicle, and taxable gross weight for each vehicle.

- Choose your filing method: Decide whether to file Form 2290 electronically or by paper. Filing form 2290 electronically is quicker and easier, but if you file by paper, send it to the correct IRS address.

- Fill out the basic information: In Part, I, enter your business name, address, and EIN.

- Fill out the vehicle information: In Part II, enter each vehicle’s VIN and taxable gross weight.

- Indicate any special circumstances: Check the appropriate boxes in Part III if your vehicle is used exclusively for agriculture, if you are suspending tax for a vehicle that travels less than 5,000 miles, or if the vehicle was sold or destroyed during the tax period.

- Calculate the tax: In Part IV, calculate the tax due based on the taxable gross weight of each vehicle.

- Sign and date the form: In Part V, sign and date the form to certify the correct information.

By following these steps and filling out the form accurately, you can ensure that your Form 2290 is filed correctly and avoid any potential penalties or delays.

How Do I eFile Form 2290?

Here’s a step-by-step guide on how to eFile Form 2290:

- Choose an IRS-authorized e-file provider: You can find a list of approved e-file providers on the IRS website. Make sure you choose a reputable provider that meets your needs.

- Gather your information: You will need your EIN, VINs for each vehicle, and the taxable gross weight for each vehicle.

- Create an account with your chosen eFile provider: Follow the instructions to create an account with your chosen IRS approved 2290 e-file provider. EZ2290 is an IRS-authorized eFile service provider for Form 2290, create an account now and file HVUT 2290 Forms in three simple steps.

- Enter your business information: Your business name, address, and other relevant information must be entered.

- Enter your vehicle information: You must enter each vehicle’s VIN and taxable gross weight.

- Calculate your tax: The e-file provider will automatically calculate the tax due based on your provided information.

- Submit your form: Review it to ensure all the information is accurate, and then submit it to the IRS through your e-file provider.

- Pay your tax: You can pay your tax electronically using various payment methods, including electronic funds withdrawal (EFW), credit card, or electronic federal tax payment system (EFTPS).

- Receive your stamped Schedule 1: Once the IRS accepts your form and payment, you will receive a stamped Schedule 1 as proof of payment. You can download a copy of this document from your eFile provider’s website.

Easily eFile Form 2290 Online With EZ2290

If you’re looking for a quick and easy way to File 2290 online, look no further than EZ2290. As an IRS-authorized eFiling service provider, EZ2290 offers a streamlined process for submitting your heavy highway vehicle use tax return.

Here are some prominent features of EZ2290 that make it a perfect fit for your eFiling needs:

- Automatic tax calculations: EZ2290 offers automatic tax calculations, which means the system will calculate the tax owed based on your vehicle’s weight and other factors, making it easy to file your taxes correctly.

- Bulk Upload: With EZ2290, you can upload multiple vehicles simultaneously, saving time and effort. You can also save vehicle information for future use, making it easier to file taxes in subsequent years.

- Paperless storage: EZ2290 offers paperless storage, meaning you can access all your tax documents online, anytime, anywhere. This is a great way to keep track of your tax filings and ensure that you never lose important documents.

- Free VIN corrections: If you make a mistake in your VIN number, EZ2290 offers free VIN corrections, ensuring you can file your taxes correctly and avoid penalties.

- Penalty prevention: EZ2290 offers a penalty prevention program, ensuring you never miss a deadline or file your taxes incorrectly, helping you avoid costly penalties.

- Bank-grade security: EZ2290 uses bank-grade security to protect your personal and financial information, ensuring your data is safe and secure.

- Mobile-friendly website: The EZ2290 website is mobile-friendly, meaning you can file taxes from anywhere, using any device.

These features make EZ2290 an excellent choice for anyone who needs to file Form 2290. The platform is easy to use, secure, and reliable, ensuring you can file your taxes quickly and accurately without hassle or stress.

Due Dates For Filing Form 2290

Form 2290 is an annual tax form used to report and pay Heavy Vehicle Use Tax (HVUT) to the IRS. The Form 2290 due date depends on the vehicle’s first use month. Here are the key due dates to keep in mind:

- For vehicles first used in July: August 31st of the same year

- For vehicles first used in August: September 30th of the same year

- For vehicles first used in September: October 31st of the same year

- For all other vehicles, the due date is August 31st of the following year

Understanding IRS Form 2290 Schedule 1

IRS Form 2290 Schedule 1 is proof of payment for the Heavy Vehicle Use Tax (HVUT) required for any vehicle with a gross weight of 55,000 pounds or more. The Schedule 1 form is issued by the IRS after the HVUT payment is made, either by paper filing or e-filing.

It shows the date of payment, the amount of tax paid, and the vehicle identification number (VIN) of the taxed vehicle. This form is required for many activities related to owning and operating a heavy vehicle, including registration, renewals, and other federal filings.

What Is the Form 2290 Amendment?

Form 2290 Amendment is a process to make changes or corrections to the information provided on the original Form 2290 filed for Heavy Vehicle Use Tax (HVUT). Amendments may be required for several reasons, such as VIN corrections, taxable gross weight increases, and adding or removing vehicles from the original filing.

It is essential to file an amendment to avoid any potential penalties or issues with the IRS. Filing a Form 2290 Amendment is similar to filing the original form and can be done electronically using an authorized e-file provider or through the mail by sending a paper form.

What Are The Penalties For Not Filing Form 2290

You’ll face penalties and interest charges if you don’t file Form 2290 or pay your HVUT by the deadline. The penalty for late filing is 4.5% of the total tax due, assessed monthly for up to five months. The penalty for failure to pay the tax due on time is 0.5% of the unpaid tax amount, assessed every month for up to five months.

Conclusion

In conclusion, Form 2290 is a crucial document for heavy vehicle owners that serves as proof of payment for the Heavy Vehicle Use Tax (HVUT). The HVUT is a federal tax that helps fund road and highway maintenance across the United States.

It is important to understand the purpose of Form 2290, its due dates, and how to properly file it to avoid any penalties or issues with the IRS. Using an authorized eFiling service provider such as EZ2290 can simplify the process and ensure that your tax filings are accurate and timely.

Who Uses Form 2290?

Form 2290, also known as the Heavy Highway Vehicle Use Tax Return, is used by truck owners and operators to report and pay the federal excise tax on heavy highway vehicles with a taxable gross weight of 55,000 pounds or more. But who exactly uses Form 2290? Let’s examine the types of individuals and organizations required to file this important tax form.

Truck Owners and Operators

The primary users of Form 2290 are truck owners and operators who own or lease heavy highway vehicles. These vehicles can include trucks, buses, and other large vehicles used for business purposes. Truck owners and operators must file Form 2290 and pay the federal excise tax on their vehicles if they have a taxable gross weight of 55,000 pounds or more and are driven on public highways.

Trucking Companies

Trucking companies that own or lease heavy highway vehicles must also file Form 2290 and pay the federal excise tax on their vehicles. This includes companies that operate a fleet of trucks for business purposes and individual trucking contractors who own or lease their own vehicles.

Tax Professionals

Tax professionals who work with trucking companies and individual trucking contractors may also use Form 2290 to assist their clients in meeting their tax obligations. Tax professionals can provide guidance and advice on the tax requirements for heavy highway vehicles and help their clients file Form 2290 accurately and on time.

State and Federal Agencies

State and federal agencies that regulate the transportation industry may also use Form 2290 to monitor compliance with federal tax laws. These agencies can use the information provided on Form 2290 to ensure that truck owners and operators are paying the appropriate federal excise tax and meeting their tax obligations.

Form 2290 Taxable Gross Weight: What You Need To Know

Taxable gross weight is the total weight of a vehicle, including any load it carries, excluding any trailers. This weight determines if truck owners and operators must file Form 2290 and pay federal excise tax on vehicles with a taxable gross weight of 55,000 pounds or more. Taxable gross weight is the vehicle’s weight when fully loaded and ready for use on public highways.

Knowing the taxable gross weight of your vehicle is crucial when filing Form 2290. Truck owners and operators must accurately report the taxable gross weight of their vehicles to ensure they pay the correct amount of federal excise tax. In addition, failure to file or pay the tax on time can result in penalties and interest charges.

Exceptions For Form 2290

While most truck owners and operators are required to file Form 2290 and pay the federal excise tax on heavy highway vehicles, there are certain exceptions to this requirement. Here are some of the most common exceptions for Form 2290:

- Low Mileage Vehicles: If a vehicle is expected to travel less than 5,000 miles during the tax period (July 1 to June 30), it is considered a low mileage vehicle and is exempt from the federal excise tax.

- Government Vehicles: Vehicles owned and operated by the federal government, state governments, local governments, and Indian tribal governments are exempt from the federal excise tax.

- Agricultural Vehicles: Vehicles used primarily for farming purposes and with a gross weight of 55,000 pounds or less are exempt from the federal excise tax.

- Qualified Blood Collector Vehicles: Blood collector vehicles operated by qualified blood collector organizations are exempt from the federal excise tax.

- Special Mobile Machinery: Vehicles not designed to carry loads over public highways and used exclusively for certain purposes such as construction, manufacturing, and drilling operations are exempt from the federal excise tax.

It’s important to note that while these vehicles may be exempt from the federal excise tax, they may still be required to file Form 2290 for other reasons, such as registering the vehicle with the state or for certain state-specific taxes.

Additionally, certain requirements must be met to qualify for these exemptions, so consulting with a tax professional or the IRS is important for guidance.

Form 2290 Boxes Explained

Form 2290 is a crucial tax form for truck owners and operators. To accurately report and pay the federal excise tax on heavy highway vehicles, it’s important to understand the various boxes on the form. Here’s a guide to help you understand what each box on Form 2290 means:

Box 1: Enter the taxable gross weight of the vehicle and any trailers for the period from July 1 to June 30.

Box 2: Check whether you report the current tax period or an amended return.

Box 3: Enter the vehicle’s vehicle identification number (VIN). This should be a 17-character alphanumeric code that’s unique to each vehicle.

Box 4: Enter the name and address of the person or business that owns the vehicle.

Box 5: Check whether the vehicle is used for agricultural purposes.

Box 6: Check whether the vehicle is a logging vehicle.

Box 7: Enter the miles the vehicle is expected to travel during the tax period if it’s a suspended vehicle.

Box 8: Check whether you’re filing as an individual or a business.

Box 9: Enter the name and address of the person to contact if the IRS has questions about the return.

Box 10: Enter the Electronic Filing Identification Number (EFIN) if you’re a tax professional e-filing the return.

Box 11: Enter the federal excise tax due for the vehicle.

Box 12: Enter the date the vehicle was first used on public highways during the tax period.

By understanding what each box on Form 2290 means, you can ensure that you accurately report the necessary information and pay the correct amount of federal excise tax.

How Do I Fill Out Form 2290?

- Gather all necessary information: Before starting to fill out Form 2290, make sure you have all the necessary information, including your Employer Identification Number (EIN), Vehicle Identification Numbers (VINs) for each vehicle, and taxable gross weight for each vehicle.

- Choose your filing method: Decide whether to file Form 2290 electronically or by paper. Filing form 2290 electronically is quicker and easier, but if you file by paper, send it to the correct IRS address.

- Fill out the basic information: In Part, I, enter your business name, address, and EIN.

- Fill out the vehicle information: In Part II, enter each vehicle’s VIN and taxable gross weight.

- Indicate any special circumstances: Check the appropriate boxes in Part III if your vehicle is used exclusively for agriculture, if you are suspending tax for a vehicle that travels less than 5,000 miles, or if the vehicle was sold or destroyed during the tax period.

- Calculate the tax: In Part IV, calculate the tax due based on the taxable gross weight of each vehicle.

- Sign and date the form: In Part V, sign and date the form to certify the correct information.

By following these steps and filling out the form accurately, you can ensure that your Form 2290 is filed correctly and avoid any potential penalties or delays.

How Do I eFile Form 2290?

Here’s a step-by-step guide on how to eFile Form 2290:

- Choose an IRS-authorized e-file provider: You can find a list of approved e-file providers on the IRS website. Make sure you choose a reputable provider that meets your needs.

- Gather your information: You will need your EIN, VINs for each vehicle, and the taxable gross weight for each vehicle.

- Create an account with your chosen eFile provider: Follow the instructions to create an account with your chosen IRS approved 2290 e-file provider. EZ2290 is an IRS-authorized eFile service provider for Form 2290, create an account now and file HVUT 2290 Forms in three simple steps.

- Enter your business information: Your business name, address, and other relevant information must be entered.

- Enter your vehicle information: You must enter each vehicle’s VIN and taxable gross weight.

- Calculate your tax: The e-file provider will automatically calculate the tax due based on your provided information.

- Submit your form: Review it to ensure all the information is accurate, and then submit it to the IRS through your e-file provider.

- Pay your tax: You can pay your tax electronically using various payment methods, including electronic funds withdrawal (EFW), credit card, or electronic federal tax payment system (EFTPS).

- Receive your stamped Schedule 1: Once the IRS accepts your form and payment, you will receive a stamped Schedule 1 as proof of payment. You can download a copy of this document from your eFile provider’s website.

Easily eFile Form 2290 Online With EZ2290

If you’re looking for a quick and easy way to File 2290 online, look no further than EZ2290. As an IRS-authorized eFiling service provider, EZ2290 offers a streamlined process for submitting your heavy highway vehicle use tax return.

Here are some prominent features of EZ2290 that make it a perfect fit for your eFiling needs:

- Automatic tax calculations: EZ2290 offers automatic tax calculations, which means the system will calculate the tax owed based on your vehicle’s weight and other factors, making it easy to file your taxes correctly.

- Bulk Upload: With EZ2290, you can upload multiple vehicles simultaneously, saving time and effort. You can also save vehicle information for future use, making it easier to file taxes in subsequent years.

- Paperless storage: EZ2290 offers paperless storage, meaning you can access all your tax documents online, anytime, anywhere. This is a great way to keep track of your tax filings and ensure that you never lose important documents.

- Free VIN corrections: If you make a mistake in your VIN number, EZ2290 offers free VIN corrections, ensuring you can file your taxes correctly and avoid penalties.

- Penalty prevention: EZ2290 offers a penalty prevention program, ensuring you never miss a deadline or file your taxes incorrectly, helping you avoid costly penalties.

- Bank-grade security: EZ2290 uses bank-grade security to protect your personal and financial information, ensuring your data is safe and secure.

- Mobile-friendly website: The EZ2290 website is mobile-friendly, meaning you can file taxes from anywhere, using any device.

These features make EZ2290 an excellent choice for anyone who needs to file Form 2290. The platform is easy to use, secure, and reliable, ensuring you can file your taxes quickly and accurately without hassle or stress.

Due Dates For Filing Form 2290

Form 2290 is an annual tax form used to report and pay Heavy Vehicle Use Tax (HVUT) to the IRS. The Form 2290 due date depends on the vehicle’s first use month. Here are the key due dates to keep in mind:

- For vehicles first used in July: August 31st of the same year

- For vehicles first used in August: September 30th of the same year

- For vehicles first used in September: October 31st of the same year

- For all other vehicles, the due date is August 31st of the following year

Understanding IRS Form 2290 Schedule 1

IRS Form 2290 Schedule 1 is proof of payment for the Heavy Vehicle Use Tax (HVUT) required for any vehicle with a gross weight of 55,000 pounds or more. The Schedule 1 form is issued by the IRS after the HVUT payment is made, either by paper filing or e-filing.

It shows the date of payment, the amount of tax paid, and the vehicle identification number (VIN) of the taxed vehicle. This form is required for many activities related to owning and operating a heavy vehicle, including registration, renewals, and other federal filings.

What Is the Form 2290 Amendment?

Form 2290 Amendment is a process to make changes or corrections to the information provided on the original Form 2290 filed for Heavy Vehicle Use Tax (HVUT). Amendments may be required for several reasons, such as VIN corrections, taxable gross weight increases, and adding or removing vehicles from the original filing.

It is essential to file an amendment to avoid any potential penalties or issues with the IRS. Filing a Form 2290 Amendment is similar to filing the original form and can be done electronically using an authorized e-file provider or through the mail by sending a paper form.

What Are The Penalties For Not Filing Form 2290

You’ll face penalties and interest charges if you don’t file Form 2290 or pay your HVUT by the deadline. The penalty for late filing is 4.5% of the total tax due, assessed monthly for up to five months. The penalty for failure to pay the tax due on time is 0.5% of the unpaid tax amount, assessed every month for up to five months.

Conclusion

In conclusion, Form 2290 is a crucial document for heavy vehicle owners that serves as proof of payment for the Heavy Vehicle Use Tax (HVUT). The HVUT is a federal tax that helps fund road and highway maintenance across the United States.

It is important to understand the purpose of Form 2290, its due dates, and how to properly file it to avoid any penalties or issues with the IRS. Using an authorized eFiling service provider such as EZ2290 can simplify the process and ensure that your tax filings are accurate and timely.

Attention all truck drivers and fleet owners! If you’re unfamiliar with Form 2290, it’s time to rev up your tax knowledge. This essential IRS form is critical for heavy vehicle taxes, and non-compliance can result in serious penalties. In this comprehensive blog, we’ll guide you through the ins and outs of Form 2290, from who needs to file to how to file correctly.

If you own or operate a heavy vehicle with a gross weight of 55,000 pounds or more, then you’ve likely heard of Form 2290. This IRS form is a critical component of maintaining the nation’s highways and transportation systems, and understanding its purpose is essential if you want to comply with the law.

But for those new to heavy vehicles and taxes: “What is Form 2290?” Don’t worry; we’ve got you covered. In this blog post, we’ll deep dive into everything you need to know about Form 2290, from who needs to file it to how to do so accurately and efficiently.

So, buckle up and get ready to become a Form 2290 expert!

What Is Form 2290? Understanding The Basics

2290 Form, also known as the Heavy Highway Vehicle Use Tax Return, is a federal tax form used to report and pay the heavy vehicle use tax (HVUT) to the Internal Revenue Service (IRS). This tax is imposed on heavy vehicles that operate on public highways with a gross weight of 55,000 pounds or more. The HVUT funds highway construction and maintenance projects throughout the country.

What Is The Purpose Of Form 2290?

Form 2290 is to collect revenue for constructing and maintaining highways and other transportation infrastructure. The revenue generated from the federal excise tax on heavy highway vehicles is used to fund the Highway Trust Fund, which provides funding for highway, bridge, and transit projects across the United States.

In addition to funding transportation infrastructure, Form 2290 also serves as a way for the Internal Revenue Service (IRS) to keep track of heavy highway vehicles and ensure compliance with federal tax laws. By requiring truck owners and operators to report and pay the federal excise tax, the IRS can monitor and regulate the use of heavy vehicles on public highways.

Who Uses Form 2290?

Form 2290, also known as the Heavy Highway Vehicle Use Tax Return, is used by truck owners and operators to report and pay the federal excise tax on heavy highway vehicles with a taxable gross weight of 55,000 pounds or more. But who exactly uses Form 2290? Let’s examine the types of individuals and organizations required to file this important tax form.

Truck Owners and Operators

The primary users of Form 2290 are truck owners and operators who own or lease heavy highway vehicles. These vehicles can include trucks, buses, and other large vehicles used for business purposes. Truck owners and operators must file Form 2290 and pay the federal excise tax on their vehicles if they have a taxable gross weight of 55,000 pounds or more and are driven on public highways.

Trucking Companies

Trucking companies that own or lease heavy highway vehicles must also file Form 2290 and pay the federal excise tax on their vehicles. This includes companies that operate a fleet of trucks for business purposes and individual trucking contractors who own or lease their own vehicles.

Tax Professionals

Tax professionals who work with trucking companies and individual trucking contractors may also use Form 2290 to assist their clients in meeting their tax obligations. Tax professionals can provide guidance and advice on the tax requirements for heavy highway vehicles and help their clients file Form 2290 accurately and on time.

State and Federal Agencies

State and federal agencies that regulate the transportation industry may also use Form 2290 to monitor compliance with federal tax laws. These agencies can use the information provided on Form 2290 to ensure that truck owners and operators are paying the appropriate federal excise tax and meeting their tax obligations.

Form 2290 Taxable Gross Weight: What You Need To Know

Taxable gross weight is the total weight of a vehicle, including any load it carries, excluding any trailers. This weight determines if truck owners and operators must file Form 2290 and pay federal excise tax on vehicles with a taxable gross weight of 55,000 pounds or more. Taxable gross weight is the vehicle’s weight when fully loaded and ready for use on public highways.

Knowing the taxable gross weight of your vehicle is crucial when filing Form 2290. Truck owners and operators must accurately report the taxable gross weight of their vehicles to ensure they pay the correct amount of federal excise tax. In addition, failure to file or pay the tax on time can result in penalties and interest charges.

Exceptions For Form 2290

While most truck owners and operators are required to file Form 2290 and pay the federal excise tax on heavy highway vehicles, there are certain exceptions to this requirement. Here are some of the most common exceptions for Form 2290:

- Low Mileage Vehicles: If a vehicle is expected to travel less than 5,000 miles during the tax period (July 1 to June 30), it is considered a low mileage vehicle and is exempt from the federal excise tax.

- Government Vehicles: Vehicles owned and operated by the federal government, state governments, local governments, and Indian tribal governments are exempt from the federal excise tax.

- Agricultural Vehicles: Vehicles used primarily for farming purposes and with a gross weight of 55,000 pounds or less are exempt from the federal excise tax.

- Qualified Blood Collector Vehicles: Blood collector vehicles operated by qualified blood collector organizations are exempt from the federal excise tax.

- Special Mobile Machinery: Vehicles not designed to carry loads over public highways and used exclusively for certain purposes such as construction, manufacturing, and drilling operations are exempt from the federal excise tax.

It’s important to note that while these vehicles may be exempt from the federal excise tax, they may still be required to file Form 2290 for other reasons, such as registering the vehicle with the state or for certain state-specific taxes.

Additionally, certain requirements must be met to qualify for these exemptions, so consulting with a tax professional or the IRS is important for guidance.

Form 2290 Boxes Explained

Form 2290 is a crucial tax form for truck owners and operators. To accurately report and pay the federal excise tax on heavy highway vehicles, it’s important to understand the various boxes on the form. Here’s a guide to help you understand what each box on Form 2290 means:

Box 1: Enter the taxable gross weight of the vehicle and any trailers for the period from July 1 to June 30.

Box 2: Check whether you report the current tax period or an amended return.

Box 3: Enter the vehicle’s vehicle identification number (VIN). This should be a 17-character alphanumeric code that’s unique to each vehicle.

Box 4: Enter the name and address of the person or business that owns the vehicle.

Box 5: Check whether the vehicle is used for agricultural purposes.

Box 6: Check whether the vehicle is a logging vehicle.

Box 7: Enter the miles the vehicle is expected to travel during the tax period if it’s a suspended vehicle.

Box 8: Check whether you’re filing as an individual or a business.

Box 9: Enter the name and address of the person to contact if the IRS has questions about the return.

Box 10: Enter the Electronic Filing Identification Number (EFIN) if you’re a tax professional e-filing the return.

Box 11: Enter the federal excise tax due for the vehicle.

Box 12: Enter the date the vehicle was first used on public highways during the tax period.

By understanding what each box on Form 2290 means, you can ensure that you accurately report the necessary information and pay the correct amount of federal excise tax.

How Do I Fill Out Form 2290?

- Gather all necessary information: Before starting to fill out Form 2290, make sure you have all the necessary information, including your Employer Identification Number (EIN), Vehicle Identification Numbers (VINs) for each vehicle, and taxable gross weight for each vehicle.

- Choose your filing method: Decide whether to file Form 2290 electronically or by paper. Filing form 2290 electronically is quicker and easier, but if you file by paper, send it to the correct IRS address.

- Fill out the basic information: In Part, I, enter your business name, address, and EIN.

- Fill out the vehicle information: In Part II, enter each vehicle’s VIN and taxable gross weight.

- Indicate any special circumstances: Check the appropriate boxes in Part III if your vehicle is used exclusively for agriculture, if you are suspending tax for a vehicle that travels less than 5,000 miles, or if the vehicle was sold or destroyed during the tax period.

- Calculate the tax: In Part IV, calculate the tax due based on the taxable gross weight of each vehicle.

- Sign and date the form: In Part V, sign and date the form to certify the correct information.

By following these steps and filling out the form accurately, you can ensure that your Form 2290 is filed correctly and avoid any potential penalties or delays.

How Do I eFile Form 2290?

Here’s a step-by-step guide on how to eFile Form 2290:

- Choose an IRS-authorized e-file provider: You can find a list of approved e-file providers on the IRS website. Make sure you choose a reputable provider that meets your needs.

- Gather your information: You will need your EIN, VINs for each vehicle, and the taxable gross weight for each vehicle.

- Create an account with your chosen eFile provider: Follow the instructions to create an account with your chosen IRS approved 2290 e-file provider. EZ2290 is an IRS-authorized eFile service provider for Form 2290, create an account now and file HVUT 2290 Forms in three simple steps.

- Enter your business information: Your business name, address, and other relevant information must be entered.

- Enter your vehicle information: You must enter each vehicle’s VIN and taxable gross weight.

- Calculate your tax: The e-file provider will automatically calculate the tax due based on your provided information.

- Submit your form: Review it to ensure all the information is accurate, and then submit it to the IRS through your e-file provider.

- Pay your tax: You can pay your tax electronically using various payment methods, including electronic funds withdrawal (EFW), credit card, or electronic federal tax payment system (EFTPS).

- Receive your stamped Schedule 1: Once the IRS accepts your form and payment, you will receive a stamped Schedule 1 as proof of payment. You can download a copy of this document from your eFile provider’s website.

Easily eFile Form 2290 Online With EZ2290

If you’re looking for a quick and easy way to File 2290 online, look no further than EZ2290. As an IRS-authorized eFiling service provider, EZ2290 offers a streamlined process for submitting your heavy highway vehicle use tax return.

Here are some prominent features of EZ2290 that make it a perfect fit for your eFiling needs:

- Automatic tax calculations: EZ2290 offers automatic tax calculations, which means the system will calculate the tax owed based on your vehicle’s weight and other factors, making it easy to file your taxes correctly.

- Bulk Upload: With EZ2290, you can upload multiple vehicles simultaneously, saving time and effort. You can also save vehicle information for future use, making it easier to file taxes in subsequent years.

- Paperless storage: EZ2290 offers paperless storage, meaning you can access all your tax documents online, anytime, anywhere. This is a great way to keep track of your tax filings and ensure that you never lose important documents.

- Free VIN corrections: If you make a mistake in your VIN number, EZ2290 offers free VIN corrections, ensuring you can file your taxes correctly and avoid penalties.

- Penalty prevention: EZ2290 offers a penalty prevention program, ensuring you never miss a deadline or file your taxes incorrectly, helping you avoid costly penalties.

- Bank-grade security: EZ2290 uses bank-grade security to protect your personal and financial information, ensuring your data is safe and secure.

- Mobile-friendly website: The EZ2290 website is mobile-friendly, meaning you can file taxes from anywhere, using any device.

These features make EZ2290 an excellent choice for anyone who needs to file Form 2290. The platform is easy to use, secure, and reliable, ensuring you can file your taxes quickly and accurately without hassle or stress.

Due Dates For Filing Form 2290

Form 2290 is an annual tax form used to report and pay Heavy Vehicle Use Tax (HVUT) to the IRS. The Form 2290 due date depends on the vehicle’s first use month. Here are the key due dates to keep in mind:

- For vehicles first used in July: August 31st of the same year

- For vehicles first used in August: September 30th of the same year

- For vehicles first used in September: October 31st of the same year

- For all other vehicles, the due date is August 31st of the following year

Understanding IRS Form 2290 Schedule 1

IRS Form 2290 Schedule 1 is proof of payment for the Heavy Vehicle Use Tax (HVUT) required for any vehicle with a gross weight of 55,000 pounds or more. The Schedule 1 form is issued by the IRS after the HVUT payment is made, either by paper filing or e-filing.

It shows the date of payment, the amount of tax paid, and the vehicle identification number (VIN) of the taxed vehicle. This form is required for many activities related to owning and operating a heavy vehicle, including registration, renewals, and other federal filings.

What Is the Form 2290 Amendment?

Form 2290 Amendment is a process to make changes or corrections to the information provided on the original Form 2290 filed for Heavy Vehicle Use Tax (HVUT). Amendments may be required for several reasons, such as VIN corrections, taxable gross weight increases, and adding or removing vehicles from the original filing.

It is essential to file an amendment to avoid any potential penalties or issues with the IRS. Filing a Form 2290 Amendment is similar to filing the original form and can be done electronically using an authorized e-file provider or through the mail by sending a paper form.

What Are The Penalties For Not Filing Form 2290

You’ll face penalties and interest charges if you don’t file Form 2290 or pay your HVUT by the deadline. The penalty for late filing is 4.5% of the total tax due, assessed monthly for up to five months. The penalty for failure to pay the tax due on time is 0.5% of the unpaid tax amount, assessed every month for up to five months.

Conclusion

In conclusion, Form 2290 is a crucial document for heavy vehicle owners that serves as proof of payment for the Heavy Vehicle Use Tax (HVUT). The HVUT is a federal tax that helps fund road and highway maintenance across the United States.

It is important to understand the purpose of Form 2290, its due dates, and how to properly file it to avoid any penalties or issues with the IRS. Using an authorized eFiling service provider such as EZ2290 can simplify the process and ensure that your tax filings are accurate and timely.